Fintech Compliance Solutions

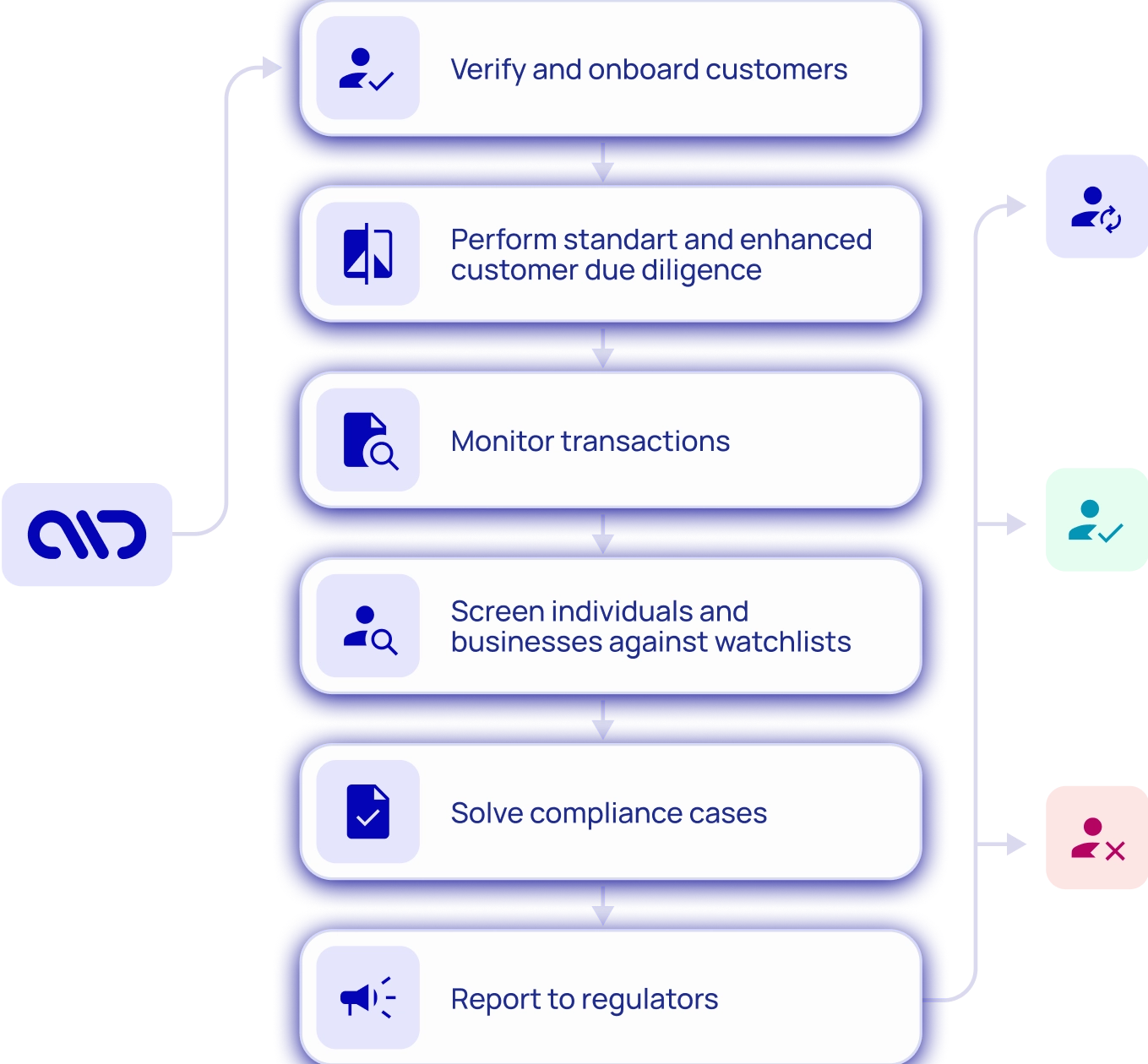

Full compliance for scaling fintechs. One platform. Unified. Intelligent. Secure.

Automate onboarding, verifications, and transaction monitoring with AI-powered tools — built to handle scale, complexity, and regulatory pressure.

WE ARE TRUSTED BY

We partner with industry leaders in compliance, identity verification, and transaction monitoring to deliver seamless, secure, and innovative solutions for modern businesses

Built For The Way Fintechs Operate

Practical use cases where A.ID reduces risk, cuts costs, and drives compliance efficiency.

01

Global Neobank Expansion

Problem

Expanding into new markets means facing multiple regulators, each with different onboarding and reporting standards. Manual fixes create delays and compliance gaps.

Solution

A.ID unifies flows across jurisdictions, adapts rules automatically, and generates regulator-ready reports to speed up audits.

02

Payments Processor Risk Control

Problem

High transaction volumes generate endless alerts, overwhelming teams and raising costs. Manual reviews slow detection and miss real risks.

Solution

A.ID uses automated rules, AI risk flags, and smart case prioritization to cut false positives and catch threats faster.

03

Crypto & Digital Asset Compliance

Problem

Exchanges face frequent audits, rising sanctions exposure, and rapidly changing AML rules that outdated legacy systems can’t handle effectively.

Solution

A.ID combines registry checks, sanctions/PEP screening, and dashboards to give full visibility and audit-ready evidence.

04

Lending Platform Scaling

Problem

More customers mean rising fraud and defaults, while manual checks delay approvals. Regulators expect stronger scoring and monitoring.

Solution

A.ID delivers automated risk scoring, AI summaries, and EDD workflows to approve faster and reduce exposure.

The Compliance Stack Fintechs Actually Need

Advanced modules that streamline complex operations and replace manual reviews with automation.

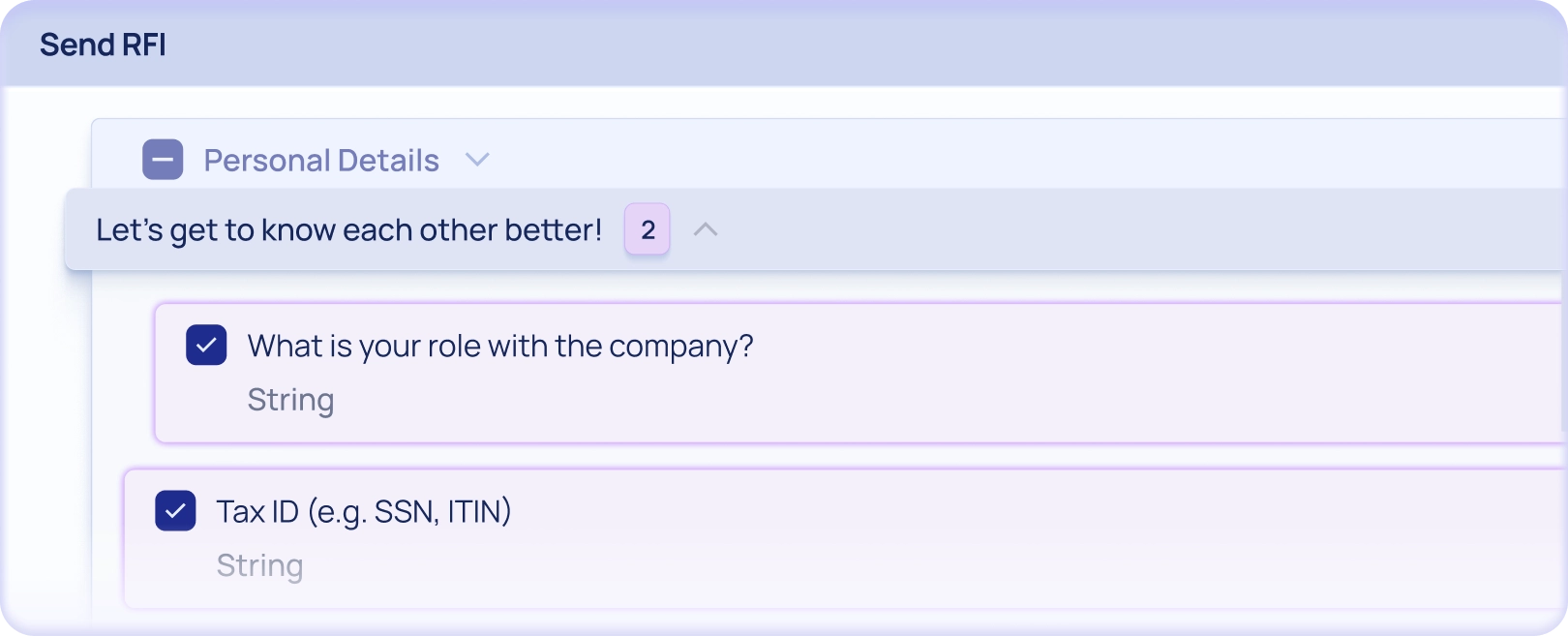

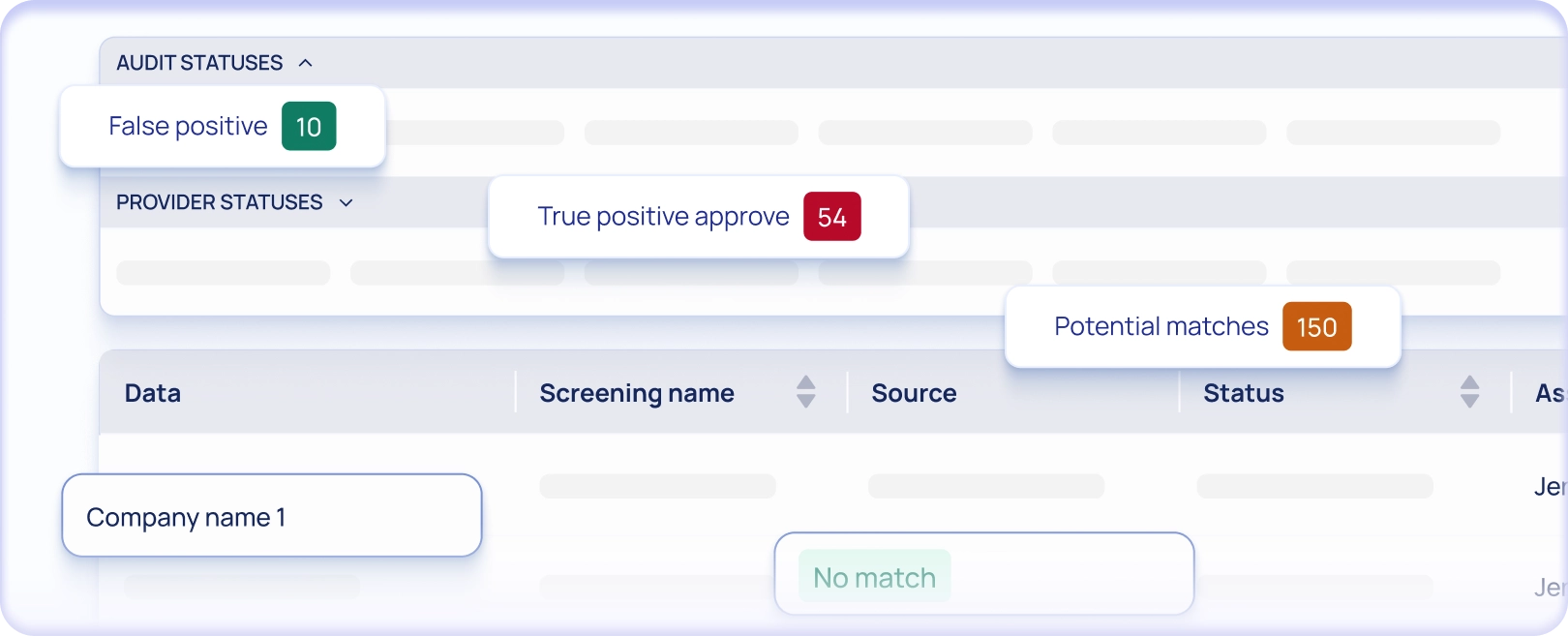

Case Management & RFI

Centralized case handling allows compliance officers to review, annotate, and escalate efficiently. Built-in RFI tools let you request missing information from clients with full audit tracking.

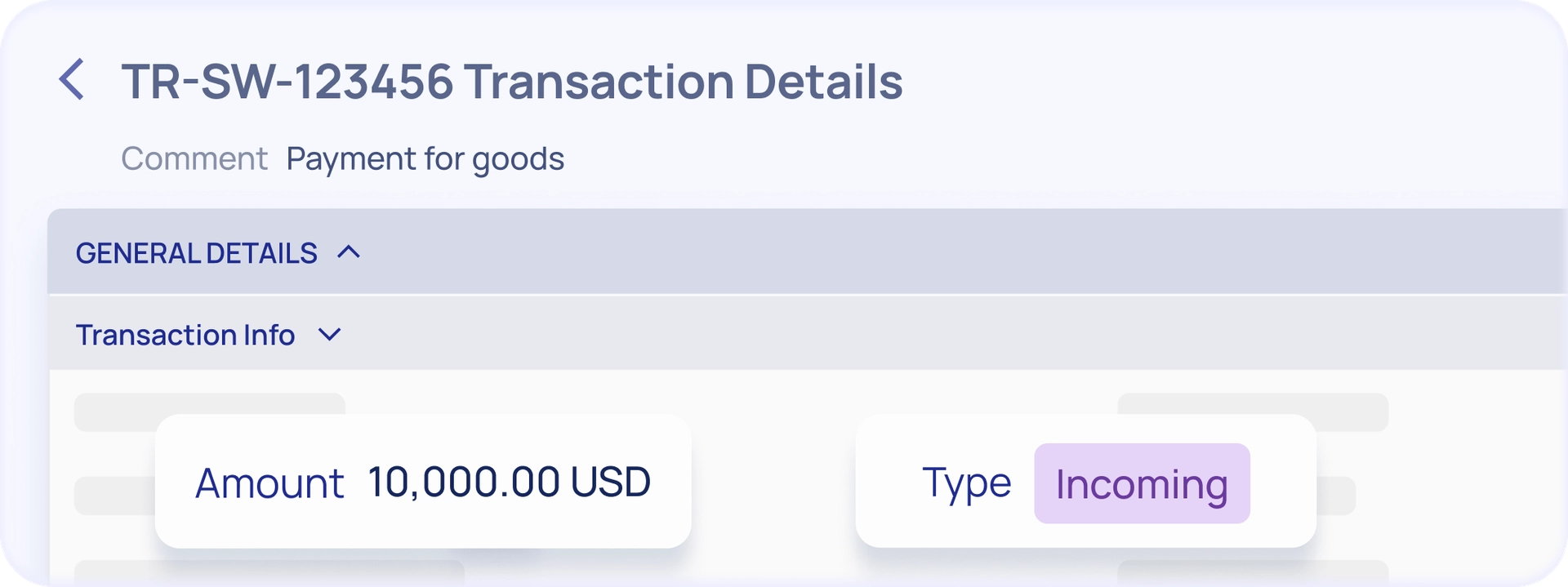

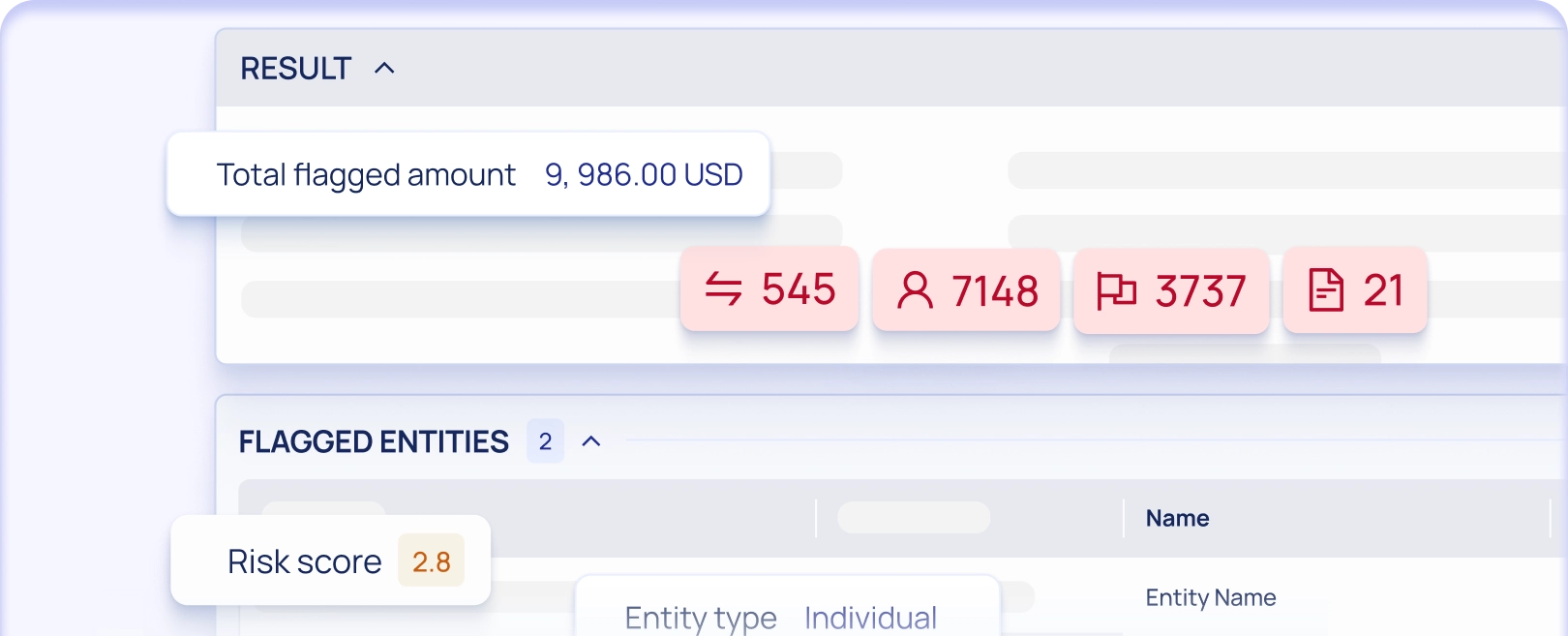

Transaction Monitoring

Monitor, analyze, and act on financial activity — in real time. A.ID’s transaction monitoring module empowers your compliance team with a fully integrated, rule-driven system that detects risk before it becomes exposure.

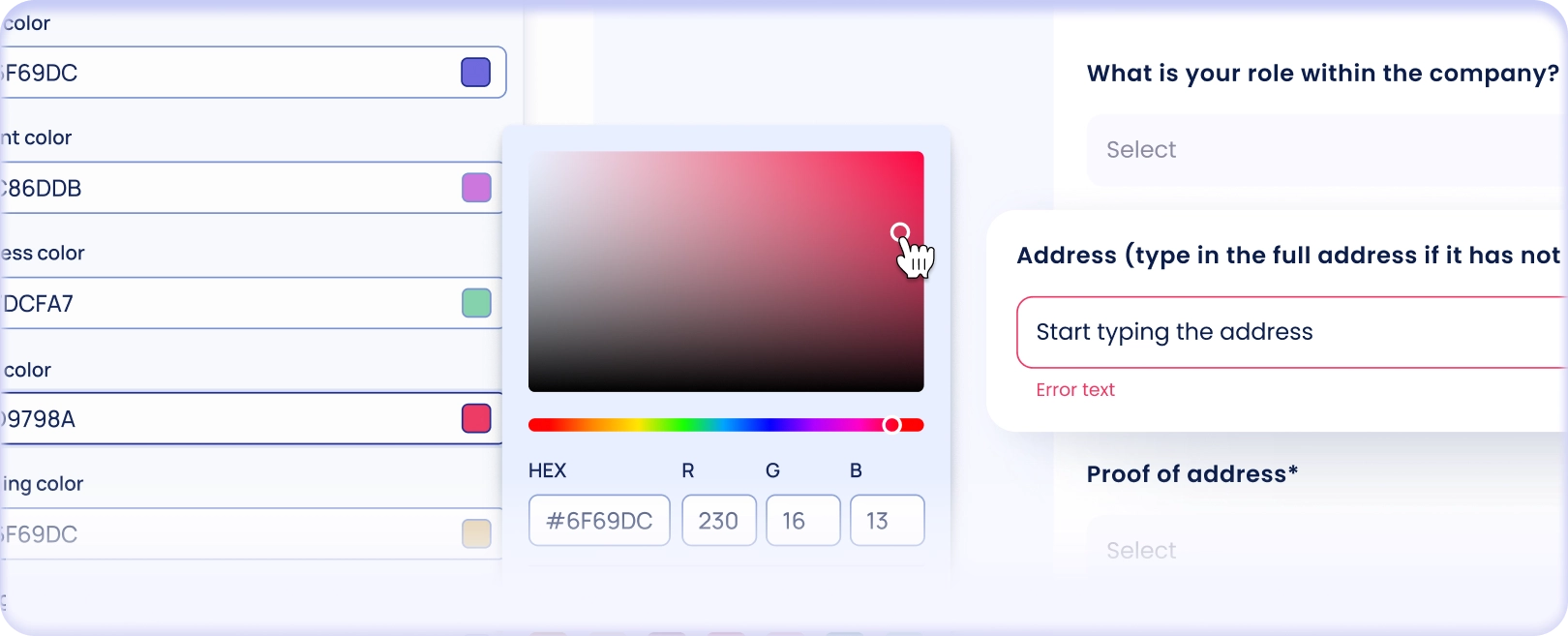

White-Label & IFrame Embeds

Launch branded onboarding flows directly in your product with IFrame embeds and styling options. Carry the same white-label experience into PDFs and emails — ensuring consistency, trust, and compliance across all client touchpoints.

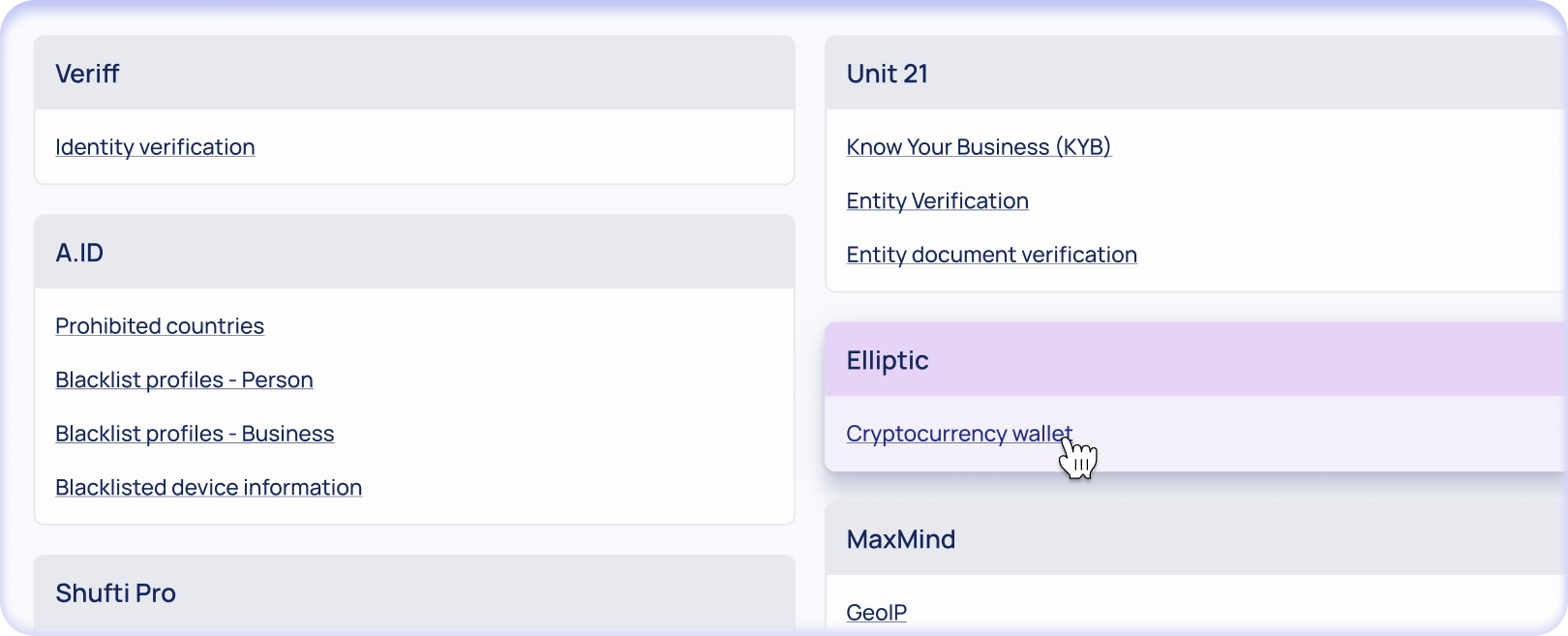

External Data Verifications

Manually select verification providers for sanctions/PEP, adverse media, and corporate registries based on your risk model. This flexibility helps optimize cost while ensuring that each case gets the right level of scrutiny.

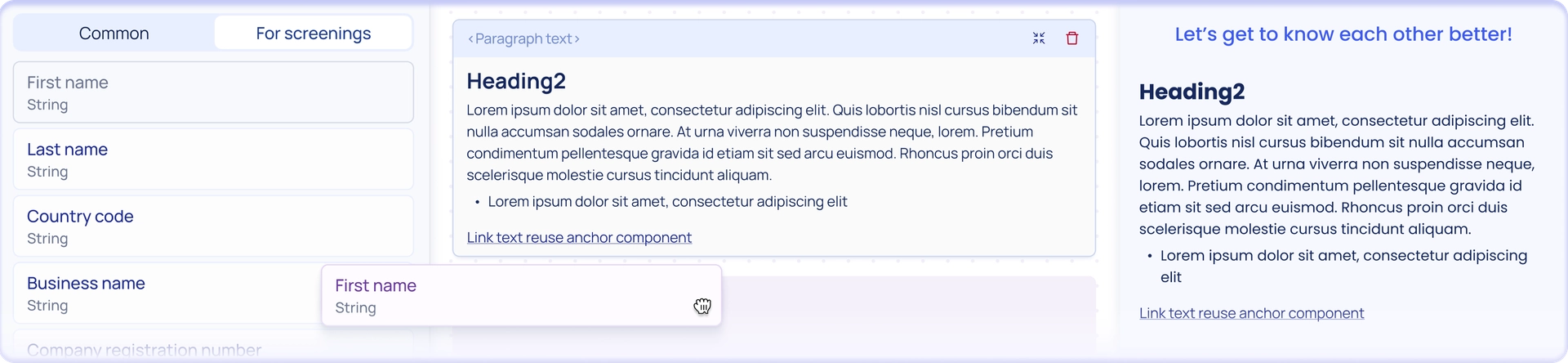

Digital Onboarding and Form Builder

Configurable, no-code forms tailored for individuals or businesses, with conditional logic that adapts to client type and jurisdiction. Built-in document upload and validation streamline data collection and reduce friction in onboarding.

Security & Governance

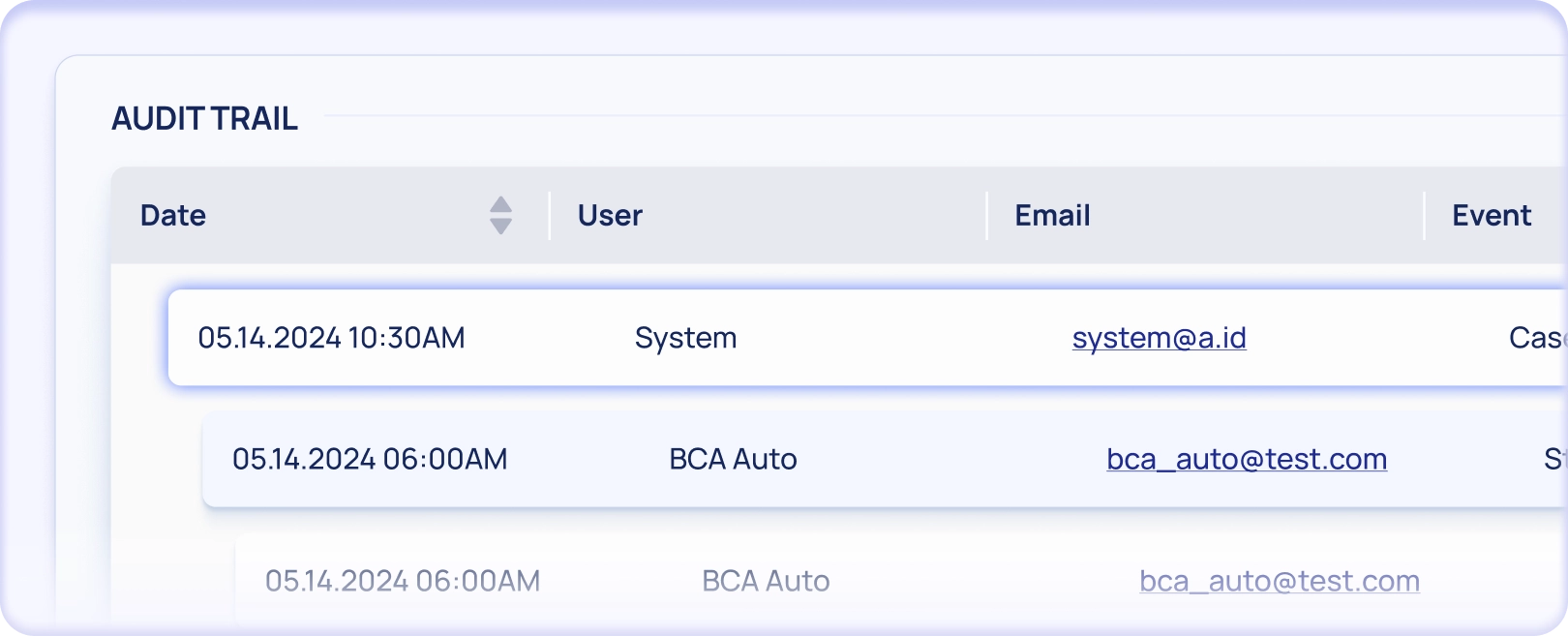

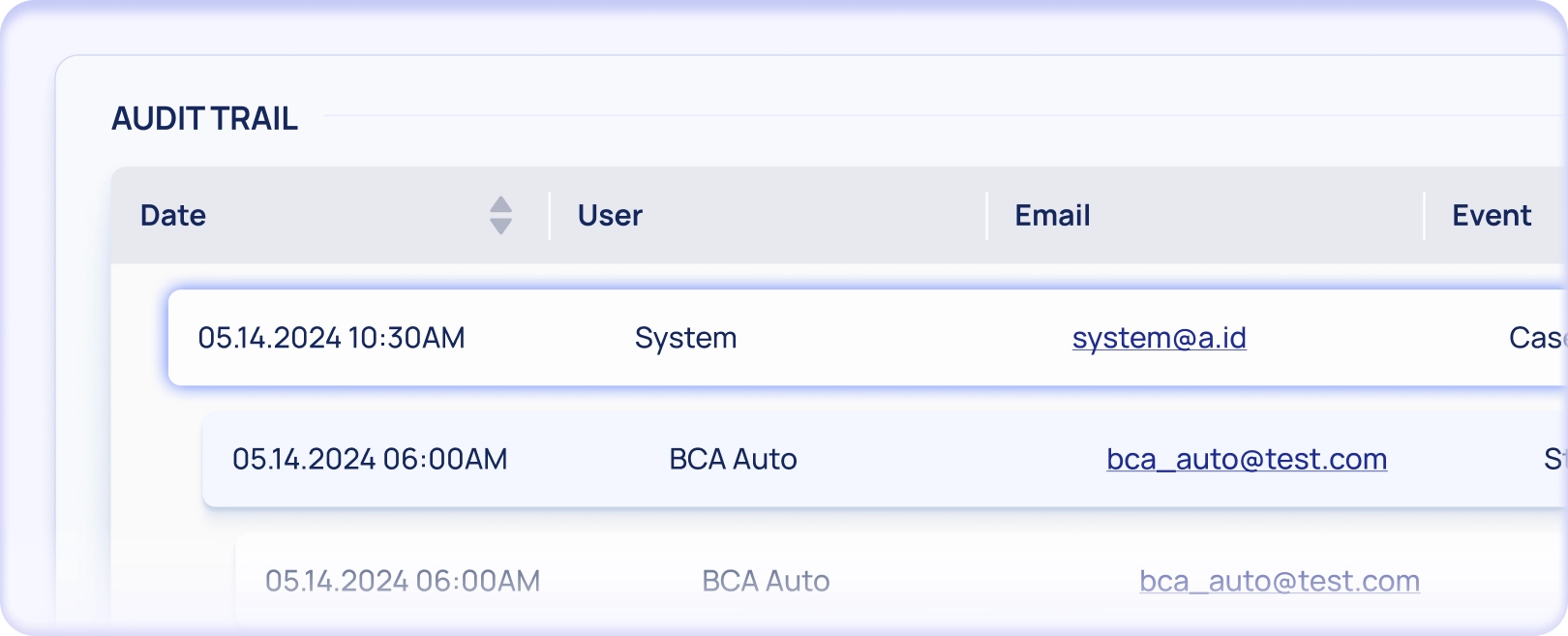

Enterprise-grade security with SOC 2 certification, role-based access, and encrypted infrastructure. Comprehensive audit logs, data residency, and retention controls ensure you stay regulator-ready.

AI Assistance

Automatically summarize submitted forms and docs into clear, actionable overviews. AI flags missing, suspicious, or inconsistent data, and provides a chat assistant for both case-specific and system-wide queries.

Risk Scoring Rules

Define simple scoring logic based on risk indicators like geography, client type, or verification outcomes. Automated actions from RFI triggers to case escalation — ensure consistency and reduce manual oversight.

Compliance Status Model

Clients are assigned managed statuses (Approved, Pending, Review, etc.) that update automatically with new verification results. Alerts are generated when IDs expire or new screenings affect an existing client.

Reduce Complexity, Stay Regulator-Ready

Solve the toughest compliance challenges fintechs face when scaling across multiple markets.

Fintech growth brings rising volumes, stricter oversight, and increasingly complex risks. A.ID simplifies compliance by combining automation, AI insights, and regulator-ready workflows into one powerful system.

Operational Efficiency

Automation and AI streamline repetitive reviews, reducing manual workload and freeing compliance teams to focus on higher-value tasks.

Global Compliance

Jurisdiction-specific flows and localized reporting ensure consistent standards and help fintechs meet regulator demands across multiple markets.

Fraud Prevention

Real-time monitoring combined with smart risk flags minimizes exposure to financial crime and strengthens protection against evolving threats.

Future-proof Base

Easily add new providers, expand risk rules, and integrate fresh data sources without disrupting existing compliance operations.

The ideal Know-Your-Customer experience with a single integration

Fintechs face fast-changing regulatory demands and complex client verification needs that slow down growth. With A.ID you can unify and customize KYC and KYB processes — streamlining identity checks, data validation, and document collection while keeping fraud under control.

A single integration gives you scalable compliance that adapts as your business expands.

Bank-Grade Protection For Fintech Innovation

Certified infrastructure, encrypted data, and continuous monitoring to deliver regulator trust and client confidence.

SOC 2 Type II Certified

Independent audits confirm A.ID meets strict security, availability, and data integrity standards.

Immutable Audit Logs

Every action is recorded in tamper-proof logs to support transparency and regulator reviews.

End-to-End Encryption

All client data is protected in transit and at rest with AES-256 encryption.

Independent Penetration Tests

Regular third-party penetration testing identifies and addresses vulnerabilities proactively.

Role-Based Access Control

Granular permissions ensure only authorized team members can view or act on sensitive data.

Continuous Monitoring

Automated checks detect anomalies in real time, boosting resilience against emerging threats.

Start using today

Start instantly

No integration required to start using our services

Just paste a link

Start from simply pasting a shortlink to your own app

Flexible branding

Extensive whitelabel options to match your style

Easy API

Easy API integration available for complex apps

A.ID Europe UAB | Savanoriu avenue 6, Vilnius, LT-03116, Lithuania

© 2025 A.ID Europe UAB. All rights reserved